First Direct (owned by HSBC) customers will be the first to benefit from the technology, with both forms of security planned for roll out in the coming weeks. This will be followed by HSBC releasing the technology for their own customers in the summer.

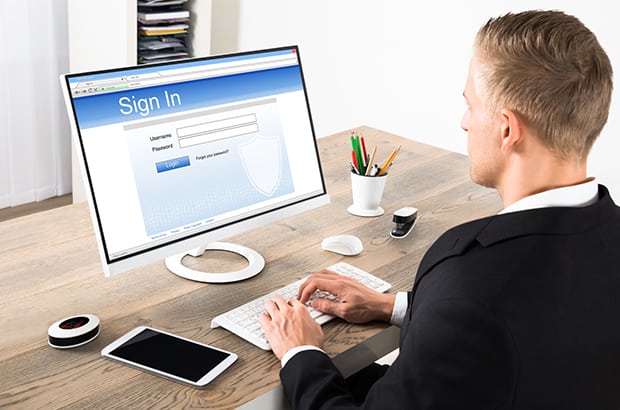

The bank believes the new technology will also make signing into online banking simpler and more efficient, as well as improving the security of the systems.

HSBC are not the first bank to introduce either of these technologies in the UK. Barclays have already introduced voice recognition authentication to some of their accounts –available to corporate clients at the moment. Both RBS and NatWest have already implemented finger print access, introducing the technology in 2015.

However HSBC’s move looks set to be the most comprehensive ID authentication shake-up in UK banking history.

Voice recognition and touch security are just two forms of password-alternative authentication, helping to protect online systems and accounts. As more and more of our private data is being stored remotely, it is imperative that our security and authentication processes grow more robust and intuitive.

Whilst there are still some user concerns about moving away from traditional authentication methods such as the password, the confidence displayed by high street banks could demonstrate the reliability and security of an effectively implemented multi-factor authentication process.

Exhaustive efforts are being employed by financial, tech, data firms and world leaders to diminish overreliance on the password – an outdated and often exposed form of security. Adoption of multi-factor authentication processes by massive corporations could help end users better appreciate the benefits of the technology, encouraging greater and more widespread migration.

Security is paramount for banks, and this demonstration of trust could influence other decision-makers to invest in multi-factor authentication to protect their sensitive data and user accounts. In May 2014, the UK financial sector was reported to be investing £700m every year on cybersecurity – a sum used to future-proof banks and effectively protect the nation’s money.

With more and more banks relying on multi-factor authentication, the technology looks set to play a central role in cybersecurity across all sectors and industries.

ProofID can help you develop a bespoke multi-factor authentication process which will help protect your online systems and all your clients’ and customers’ data. For more information about how ProofID can help secure your business, visit our homepage or call our dedicated team on 0161 906 1002.

Be the first to hear about news, product updates, and innovation from proofid